The Hongkong and Shanghai Banking Corporation Limited opened in Hong Kong on 3 March 1865 and in Shanghai one month later. It was the first locally owned bank to operate according to Scottish banking principles.

HSBC in Thailand

Our services

HSBC is Thailand’s first commercial bank and the leading international bank in the country. We aspire to the do the following:

- Maintain our position as the #1 bank for international inbound business into Thailand

- Become the #1 international bank for outbound Thai corporates

- Become the #1 international bank for Thai high net worth individuals and institutions growing their wealth regionally and globally

Our headquarters

HSBC Building

968 Rama IV Road

Silom, Bangrak

Bangkok

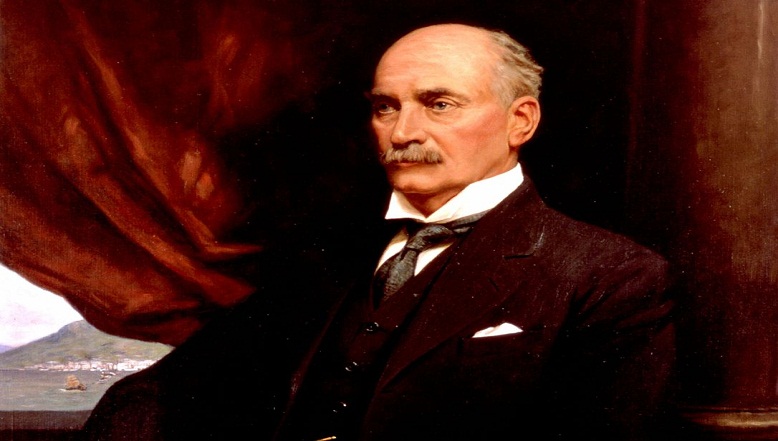

Our CEO

Giorgio Gamba

CEO and Head of Banking

Our history in Thailand

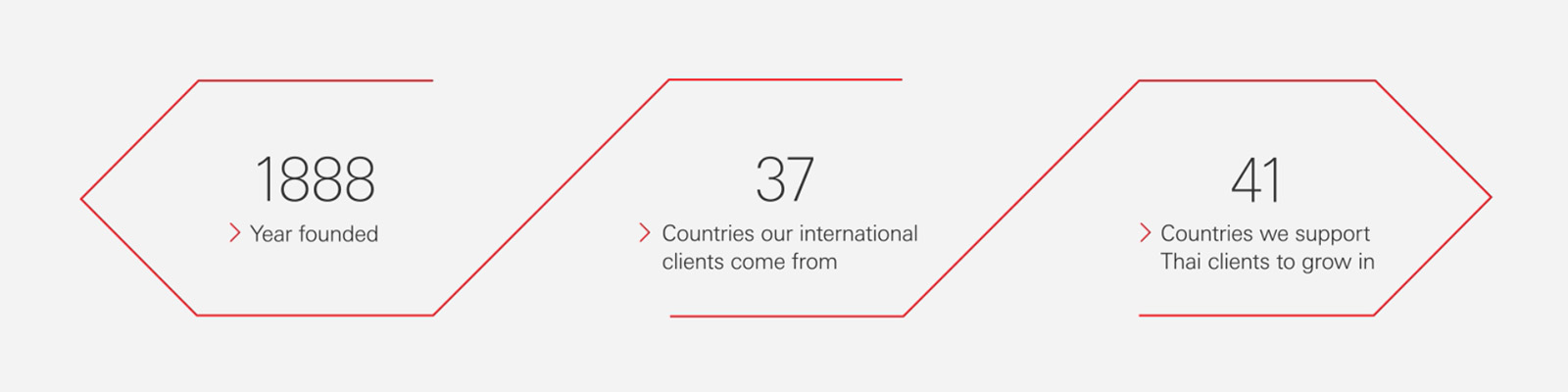

- In 1888, HSBC was established as the first commercial bank in Thailand as Hongkong and Shanghai Banking Corporation during the reign of King Chulalongkorn. Its first office was located at “the old Belgian Consulate” on Charoenkrung Road.

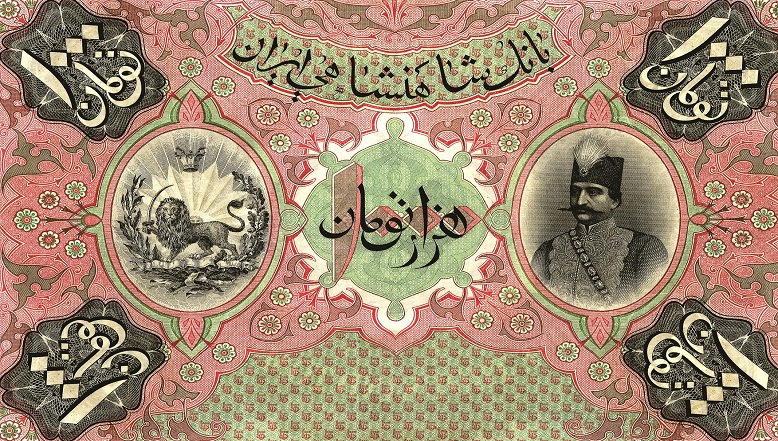

- In 1889, the bank introduced the first banknotes into Siam with the permission of Siamese authorities. The currency notes were issued in denomination of one, five, 10, 80, 90 and 100 ticals (baht) which were used widely to pay debts and taxes among customs officials and other government offices. When the Bank of Thailand issued its own banknotes in 1902, the amount of the Bank’s banknotes in circulation decreased gradually.

- In 1890, the bank moved to a Roman-style building, known today as Tanam Si Phraya, which was also the site of a luxury hotel called The Oriental for 87 years. The office building was declared officially open by HRH Prince of Chandaburi, then the Minister of Finance.

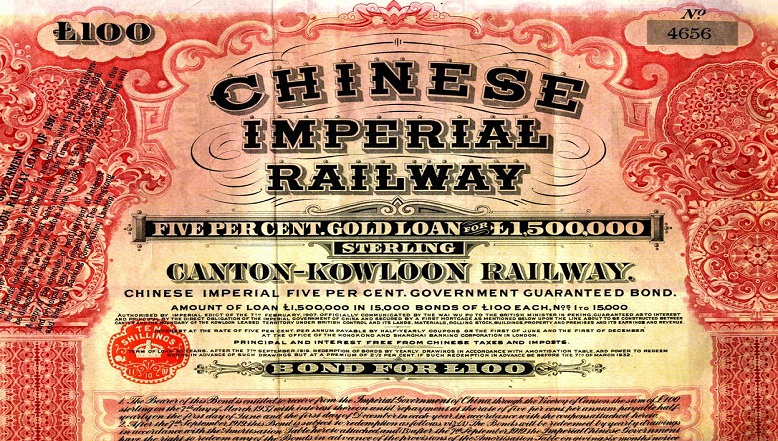

- In 1905, the first public overseas loan to the Siamese government was issued for the announced purpose of railway construction. The government, under the advice of a British financial expert, wished to retain a minimum treasury balance of 22 million baht. Railways were of a high priority in the unification and centralization of the Kingdom, and therefore the decision was made to borrow abroad.

- In 1905, the Siamese Ambassador in Paris approached two banks – one British, HSBC, and one French, Banque de I’Indo-Chine. The French and British issued bonds to rank pari passu and the loan was issued in both London and Paris. The actual signing of the agreement was celebrated with a dinner at the Savoy for 20 people including the Siamese Ambassador to Paris, Phraya Suriyanuwatr.

- In 1977, the bank moved from Tanam Si Phraya to Siam Center Department Store.

- In 1982, the bank moved to the HSBC Building on Silom road.

- In 2001, the bank moved to its current location of the HSBC Building on Rama IV road.

HSBC Group history timeline

Sustainability is unlocking business growth Opens in new window

The commercial case for sustainability has reached a critical mass, placing it firmly on the agenda of many businesses globally, says Natalie Blyth.

Carers need more tailored financial support Opens in new window

We have a responsibility to step in and address the financial challenges faced by carers – and to help them find the tailored financial support that they need, says Steve Reay.

Younger generations investing with greater confidence Opens in new window

Younger generations of savvy, digital natives are investing in their financial futures with more confidence and control than older generations, says Jenny Wang.